You know how some people flip houses?

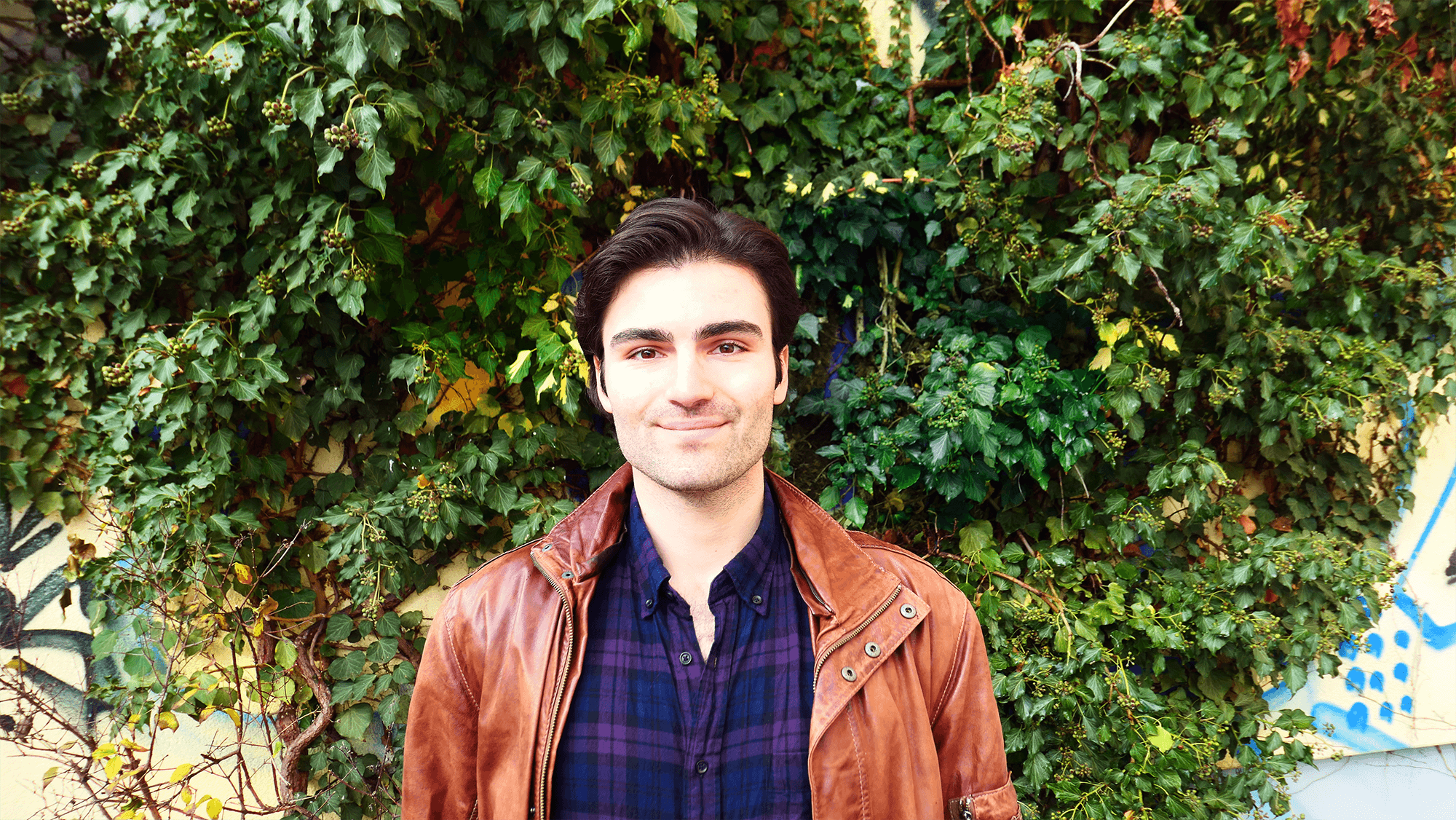

Yeah, Michael Yarmo flips BUSINESSES instead!

We talk about how he got into flipping businesses, the 80/20 of turning businesses around quickly, and opportunities he's seeing right now because of COVID.

Shownotes:

Twitter: @MichaelYarmo

Substack: https://michaelyarmo.substack.com/

Check out his program where he lays out the risks and opportunities of buying/stabilizing a distressed business: Hack the Capital Stack

https://newpointadvisors.us/

Thanks so much for listening. If you like this episode, please subscribe to the Addicted To Learning podcast and rate and review.

Transcript

You're trying to buy for pennies and sell for dollars. Definitely lots of businesses out there that are struggling in that, you know, in that a hundred to 500,000, but you know, then you're kind of on your own pretty much on your own to turn it around. You know how some people flip houses?

Yeah. That's how Michael Yarmo flips businesses, anything from consumer goods to biotech to construction. And the crazy thing is it doesn't even have a background in any of those. In this fascinating conversation, we talk about how he got into flipping businesses, the 80 20 of turning businesses around quickly and opportunities he's seeing right now because of COVID.

So without further ado, here's Michael. Okay. We have Michael Yarmo today on the show, Michael, how's it going? Hey, thanks for having me on right too. Great to be here with you. I'm very excited about today's episode, because today is all about flipping and fixing businesses. Um, before we start, maybe you can give our audience a little background on, um, uh, yeah, you're the last couple of years of, um, you know, your professional biography and how you got into, uh, fixing businesses.

Yes. Um, so I'm a managing partner with a distressed turnaround firm called a new point advisors. Uh we're we're out of Chicago, but we've got office that's going to all over North America. Uh, basically what we do is we're working with, um, smaller businesses. So let's call them the a hundred million dollars in revenue or less.

Uh, we're either, uh, working alongside management or replacing management on behalf of the ownership stacks. So that would be, uh, private equity companies, um, or, uh, even even the data stack, which is, uh, you know, banks and, uh, other financing companies. So these companies have ended up in some type of distress.

Um, the con the occurrence. Uh, stock, you know, debt or ownership doesn't know how to fix it. Uh, they don't want to lose out on, on their investment. Uh, so they call, call us into, uh, to fix the business. And, um, you know, sometimes we actually have to completely replace management if, uh, if that's what the situation calls for.

Um, you know, currently I'm currently CA CEO on a couple of firms right now, what, we're, what we're trying to, uh, to turn the business around. And ultimately, you know, we have a mandate of, you know, Let's call it a hundred to 200 days to go in, uh, do, uh, run our, run our process through, get the business fixed, uh, profitable and cash stable again, and then kind of hand it off to a, to a more long-term management.

And then we're onto the next buyer. I, uh, I entered the, I entered the space. Um, uh, well I was actually doing it well and with my own capital, with my own, uh, LP, uh, partners, uh, we had actually bought a, uh, distressed, uh, food distributor who, uh, had been in business for about 20 years, uh, had not really innovated or kind of kept up with the times.

And, um, watched a lot of their market share, kind of get washed away from more aggressive competitors, either more aggressive on price or what new, uh, new products or, um, you know, new technology on how to, um, you know, gather and process orders. And so they were really just. Kind of on their last legs, still enough of a customer base for us to come in and, um, at least see it through, through a turnaround phase.

We learned very quickly that the, um, channels that they were selling, selling through in the inventory, they were carrying. Was just too low of a, of an, uh, uh, uh, you know, gross margin to really make the business work. So we actually quickly pivoted the business into areas that we thought had, um, you know, much more upside and much higher margins, which was, uh, going from a bakery distribution business to a frozen foods, uh, distribution business.

We quickly gained some real traction. We had to upgrade a lot of the assets, whether it'd be the, um, the warehouse or the trucks, uh, get new, uh, suppliers in there and a new kind of a new customer, um, uh, stack to, uh, to sell into, but we were successful with it. Um, and it ended up doing a whole bunch of tack on acquisitions to kind of help grow the business without having to add any more, uh, uh, you know, hardcore assets or, um, capital expenditures.

And then, uh, ended up getting an offer from a, a, from a competitor about five years later and it ended up selling off the business. Okay. So I, can I just jump in here real quick? Um, just my first thought is, okay, so, uh, you're running a bakery and then you're pivoting into frozen foods. Uh, how, how are you getting this insight?

So, you know, why? Um, we quickly, we learned, you know, after a few months of operating the business, that there are a lot of guys driving around with trucks, sell, trying to sell, uh, sell you a pallet of flour or sugar or a yeast, uh, and anything that goes into, into the bakery business. And my margins, you know, quickly went from, you know, the mid thirties down to the mid-teens.

After, you know, some competitor saw blood in the water and saw that, uh, you know, a new, a new guy who's never run a distribution company before. Um, Hey, we can try to get this guy out of the market and try to take, try to take a share. So, uh, we, we looked around and said, what do the big guys, the, um, the Ciscos and the GFS does not do very well.

And we quickly discovered it was frozen foods. I went around and asked every single chef food and beverage manager, uh, supplier as to, um, what does, what are the big guys not doing very well? And the responses were always a frozen foods. It was either they had, they had very little space in their warehouse, on their trucks, a very minimal amount of inventory and lines that they carried.

And we saw, Hey, you know, if we really went wide, um, with, uh, the frozen food business, we can carry a lot more inventory and a lot more different lines so that this chef doesn't have to, um, you know, basically carry the exact same thing that, uh, everybody, every other chef does from a, from a frozen foods perspective.

Sure, sure. That makes sense. And do you focus on one particular, um, product line in particular or were you pretty, pretty broad as far as the frozen foods? We started off with what would work well for our existing customer channels. So, you know, going into bakeries, what, what frozen foods would they want?

Um, you know, it was that there were some extremely labor intensive, um, lines in the bakery let's hit, let's take croissants very, very difficult to make. So most of them are actually frozen and kind of, uh pre-baked and thawed at that, um, at the facility not actually, uh, freshly made. So we started there and started getting some traction.

But, you know, after a while that's, that's a limited market. So we actually ended up going quite wide and carrying everything from, uh, you know, frozen, uh, frozen fruits and vegetables, all the way to, um, you know, to, to muffin mixes and anything else that a, a restaurant or a bakery would need. So we went pretty, pretty wide with our inventory selection, but it really started off with just selling into, uh, your channels that you already have, and those relationships that you've already built.

Okay. Gotcha. Gotcha. And then you ended up, uh, selling the frozen foods company, right? Yeah, that's right. We weren't intending to sell, but, um, you know, we were getting offers for it and, uh, you know, eventually get an offer that you can't refuse. So we ended up selling and leaving and that's what got me into, um, the distressed, uh, distress world, uh, that I'm currently working in.

Great. And how do you, how did you, how do you get your start? What was your first, um, turnaround. So first turnaround was a medical device company. Um, so this company was run out of Florida in the, uh, spine, uh, uh, spine business. So they were doing spinal and hip implants. It was started off by an extremely intelligent PhD in bio bio mechanics who, uh, went in and developed a really cool system on how to, um, you know, actually get a spinal implant in with a far less invasive surgery.

However, um, for as good as he was at developing a product and he was extremely good at borrowing money, uh, he could never actually monetize the product. He couldn't build the processes, build the sales channels, develop a team. Um, and just like, just start monetizing, uh, all this great inventions. Um, so the bank ended up calling us and saying, Hey, you know, we've got millions of dollars, um, for, to this company.

Uh, he just can't seem to ever turn it around and make, um, make a make money out of that. Uh, we need somebody to, uh, professionally to come in and, um, you know, build, build those systems for him. So that we can actually, you know, get, get above water on our, on our bank covenants, uh, that we had set off on our agreement and actually start having him, uh, make, uh, interest in principal payments.

Cause they had done a juncture for loans, um, uh, to finance the business. Hang on. How do you even get into that position in the first place to be able to be in the position, uh, for a bank to call you up and be like, look, we need you to go in there and turn the business around. So there there's, um, there's a PA position, uh, in the, each, uh, each bank, uh, any decent sized bank called a special assets.

So special assets is when, you know, if you ever borrow money from a bank, uh, you're likely borrowing it from your local branch or online. Uh, but you're often assigned, what's called a relationship manager. The relationship manager is going to be your best friend. Uh, they're going to, uh, you know, send you a Christmas card every year, or they're going to take you out for golf trips or, uh, you know, send you to the, the latest sporting event.

Um, what, as soon as you start making principal and interest payments, or you kind of fall below what the, uh, the bank, uh, requires in terms of covenants, they're actually going to kick you out of the relationship managers, uh, jurisdiction and into what's called a special asset. Group most, most banks have one.

If it's a smaller bank, it's often managed by a chief credit officer. But what we try to do as a turnaround firm is be very visible to every single special asset, uh, division, uh, and any bank across, across the country. So these guys know that, Hey, as soon as I, uh, I have something hit my books as a special asset group, I got a turnaround from like Newpoint who will come in and actually either manage the company or, um, you know, kind of coach the coach, the current, uh, executives.

In this case, we actually assume the CEO position. Oh, hang on and on a very practical level. Right? So you, you exit your first business. You're sitting on like a lump sum of money. You're deciding you want to go into, you know, you want to help, uh, turn businesses around. Um, do you just reach out to dozens of banks and just cold call the managers to, to get an in or how do you, how did that happen?

Yeah. You know, you can, you can either, uh, cold call them and, uh, you know, but make yourself visible to them. They're often a LinkedIn. Um, and they're, you know, you can find them under our special assets or financial restructuring. Uh, they're all, uh, that's the, that's the beauty of, uh, marketing to that position.

Is that they're, they're often very visible and very active on LinkedIn. So you, uh, you know, make sure you have a LinkedIn account to, uh, to be visible to them, but really you're just, you're just getting them on their radar so that when a deal comes up and it's a very much an event driven business when they have something for you, uh, you'll be at their best friend.

Uh, but when they have, you know, when they have nothing for you, it's like, you'll likely hear crickets from them. But, you know, getting, uh, getting, getting into the, you know, into the distress space is really being very visible to, to these guys and letting them know, Hey, I've got, I've got a capital or a way of turning the business around.

It was all the, all these special assets bankers want to do is just get the, get the file off their books. And back to that relationship manager. Sure. Sure. And with that first deal that you, um, cause, uh, cause I'm assuming, uh, going off of your LinkedIn, you don't have a background in, in biotech and biomechanics.

Um, how did you know this was going to be a good deal for you to turn around? Yeah. Often a lot of the times is we don't need to know this very specifics of the deal. Um, when you're, when you're buying a distressed business, uh, you know, it's, you're not, you're not founding anything. Um, you're, you're, uh, buying something that's already got something, you know, some product on the ground.

And really you're just trying to apply some very sound business practices to a company that has not had sound business practices. So as long as you come in with, um, you know, a structure and a way to control cash and a way to, um, uh, apply some type of sales or marketing or operational structure to a business, you often don't need to know the, um, the specifics of it.

I never spent one day in biomedics before, uh, running a biomedics company. The, the very specifics of the industry. I was relying on the, uh, already established team to, uh, to kind of fill those gaps in for me, all I came in to do to fix the business was applied various, um, you know, broad, um, well honed, uh, business strategies to be able to, um, to monetize what this, what this owner had done and get, uh, get the company cash flowing again.

Okay. And let's talk about those. Uh, well, honed, uh, uh, sound, uh, business, uh, strategies and practice. So you're going in there. You'll have like a hundred, 200 days to turn it around. Uh, w what are your first, uh, yeah, always, always first moved with a, uh, with a distressed business as he got to get a handle on your cash.

Uh, your first year, the first thing you need to do is establish a 13 week cash flow model. It's um, this, the reason why I say 13 week cashflow model is because that's a very standard. A piece of documentation that banks will want to see to, uh, have, you know, for them to understand what are the, um, you know, what, what's the in and out of cash as the business continues to operate.

Because really when you're, you know, the, the risk of dealing with a distressed business as you've got a secured lender, uh, secured against some collateral in the business who can foreclose and actually shut that business down. Does it does, does that, does that just mean, this might sound dumb, but does that just mean to have 13 weeks of cash in the bank or does that mean something else?

It means you are forecasting out 13 weeks of what the, what the next 13 weeks are going to look like to see, uh, what my bank account is, what my, what, what am I going to collect from cash? And when am I going to disperse the cash? Got the end of the day. You're you're going to see, uh, how my operations are doing with the 13 week cash flow model.

Am I, am I generating cash or am I losing cash from a, you know, from operating over the next 13 weeks? And it'll be a, it'll be a role in 13 weeks. So the, the, uh, the, uh, the reason why it's rolling is because you need to keep your, you need to keep the bank and any other secured creditors, very aware as to what's happening with the business.

And a case of, uh, I need your support, not to foreclose on the assets. Yeah. That makes sense. Cause they could come in, uh, at any point in time and just foreclose on you. Right? They have, they have a lot of power to be able to just shut the business down and sell off the assets and uh, you know, basically recover, um, what they think a, uh, is reasonable to pay back, pay back their loan.

And then in this case, uh, do you, um, do you make money on, on the spread as far as like what the bank thinks the assets are worth and then what you end up, uh, generating, um, at the end or, uh, how are you making money? How are you getting paid? Uh, so you, you know, you try to take some type of management fee, uh, once you, uh, when you actually start running the business.

But the, the upside really is on the, uh, the acquisition of the, uh, of the business. And then, uh, the selling or the refinancing out of, um, you know, after that a hundred days often, what we do our clients are doing is, uh, join joining the equity stock at the beginning of the deal. Um, stabilizing the business and then ultimately holding it for, uh, for the, uh, for the long-term.

There's a, there's not a lot of selling that goes on after a hundred days. That's too short of a timeline. And the reason why I keep quoting a 100 days is because that is often the time that the bank will stand down to say, this is how long you have to take to fix the business. And as after the a hundred days, we'll kick you back to, uh, to re our relationship manager and let you kind of proceed.

Um, going forward, I've seen, I've seen up to 300, 400 days for a bank to stand down, but a hundred days is generally kind of a good rule of thumb for you to come in and apply those, you know, good, good business practices to get the company, to stop bleeding cash and make the bank, um, want to stand out. Sure.

So that means, uh, you come in with a pile of cash, you buy into the business, right? You get some equity, um, you fix up the business and then after a hundred days, you, uh, you refinance or sell off the asset, but most likely refinance, is that, is that correct? Yeah, that's, that's correct. You know, often the bow, the balance sheet, as you enter, uh, enter the transaction, doesn't have any more assets to be able to, uh, to leverage, to, uh, to create more working capital, uh, doesn't have enough cash to be able to, uh, to get to the, to the next quarter or, uh, you know, later on in the year.

So you coming in as a part of the equity stack, to be able to, um, to, to join that equity group, you're really putting cash on the balance sheet for them to, uh, to operate. And then your goal, again, over, over a certain period of time, let's call it a hundred days is to stop, stop the bleeding of the business and get it to cash flow on its own.

And that's what actually really starts to create, create the value. Because you're, you're entering into, into distress and you're trying to leave as, uh, as non-distressed and you're that's, that's your spread? And it's, you know, often it's, um, a copy is not any ending up in distress because, um, you know, you know, Amazon enters the market or there's been some major change in an industry.

A lot of times, what we see is that, uh, businesses ended up in distress is because the ownership has taken their eyes off the ball, or they've made some really poor, um, moves with working capital that, uh, has ended up, uh, with, with a cash crunch. There's often, much more micro reasons and, uh, just really fixable reasons that they can't seem to get themselves out of that has caused it.

Doesn't have to be in distress. And, and that, that is your that's your upside. Yeah. And . Gotcha. Gotcha. And can you, um, uh, uh, to buy into the business, is that a hundred percent cash, or can you apply some leverage by maybe taking out a loan and only putting, say, I know 20% cash and the rest is financed. If you apply, leverage the business, um, likely the, uh, the bank that's already referred you in has taken a secured possession.

There's likely not a lot of assets to be able to, uh, for you to get any type of collateral. So you're, you know, if you're going to put money into it as, as a debt holder, you're often coming in as unsecured, which means that the business does have to liquidate. You're going to get nothing on your, on your dollar or order or pennies.

Hmm. So, uh, and you know, often if you, if you come in as debt, you know, that's still putting pressure on your week to week cashflow model. And what we, what we see a lot is is the, um, cur you know, the ownership of the distress business has already tried to go after a higher, higher interest debt, just to try to keep money into the bank.

There's lots and lots of guys out there who are happy to happy to lend you a 15 to 20%. But that is a real that's, you know, you're starting to go down the slippery slope as a, a distressed business cause you're putting more and more pressure on your balance sheet, on your, on your cashflow just to make, to attend the next quarter.

If you come in as long-term equity, uh, that means it doesn't have to flow through the income statement. Uh, it looks a lot less pressure on your 13 week cashflow model and allows you to, uh, to see the upside at the end of the day when you're, um, when you actually sell off the business. Sure. So, so that's why your way of saying you don't generally apply leverage, right?

And you go all Pash. Yeah. Uh, the, you might've, you might as well come in as equity because the, uh, the case of, uh, an unsecured, what you're likely going to be, or a, uh, or equity. Uh, your E in either case under a liquidation scenario, if God forbid the business does have to shut down, you, uh, let's see, you can't turn it around.

Or, um, the, the situation's just too dire. You're going to end up with the same amount of, uh, collateral at the end of the day, which is likely very little to nothing. So you might as well come in as equity and try to get the upside at the end, at the end of the transaction. And that you're not putting pressure on the, on the cash flow from, uh, from interest payments.

Yeah. Um, yeah, it makes sense. So, um, what is the, what is the upside generally speaking? Um, as far as maybe, I don't know if you can talk actual dollar amounts or not. Uh, if you can take maybe percentage, uh, points, as far as, uh, you go into the business, you buy into the business, you exit the business where you refinance a hundred, 200 days later.

What are we talking? Ish. So we can get an idea. Yeah. So you're, you're trying to buy, buy for pennies and sell for dollars. So you're trying to, trying to kind of, uh, come in and, uh, you know, the more. The more distressed the businesses, the cheaper, obviously you're going to get it, but the bigger headaches, uh, that, uh, you have to deal with.

So it's, that's really, how many, how much risk do you want to, uh, take when you're buying one of these distressed businesses or how much, um, how much, um, you know, how much cash do you have to be able to weather, you know, future storms for the business before it actually gets back on its feet? So there, uh, there are definitely components to a distress business that you'll want to take a look at.

To see if you can get a better deal. And I often like to look at, um, does the owner have, does the current ownership have a lot of personal guarantees on the loans? The more the personal guarantees, the more they, they put their own balance sheet and you know, their, their house or the kid's college fund or, um, you know, their, their, their boat house or something on, um, on, uh, leverage to the bank so that if the business ever has to liquidate, they have to sell all that, all that off.

So the more personal guarantees, the better purchase price you often get and that's the, a high higher, or the outside, but really the goal, the goal is to, you know, buy for, uh, you know, some type of liquidation value, um, or, you know, book value of the business and sell it as a going concern, which could mean, you know, many, many multiples on your, on your money.

If you, if you're able to do the, the correct turnaround. And, uh, and actually start realizing, uh, uh, actual free cash flow in the business. Yeah. What, um, I'm still baffled by as, uh, how you can just go into a business that, um, you know, back to the bio biomechanics biotech business, you can just go into that business and flip it, turn it around without actually knowing about, um, this very sophisticated, um, You know, domain itself.

Um, can we, can we talk a bit more about, you know, the, the, the business fundamentals, um, because this, this seems very, very genius to me. Um, you know, because basically you're saying, um, you know, there's a lot of mismanaged businesses. Um, it doesn't matter the industry, we can just go in there, apply sound business practices and make, make bank right.

Yeah. Yeah. You know, back to the back to the biomedical device company is I didn't need to go in and understand how to, uh, you know, graft a, uh, implant onto auto somebody's spine. That work was that work that was done by already by somebody who knew how to do something like that. Those, those patents had already been filed at the, um, that those assets were already on the, on the, on the balance sheet.

What this company didn't know how to do was didn't know how to hire, hire a sales team. They know how to create a sales funnel. Didn't know how to run, uh, run operations properly, uh, to get, you know, raw materials into, into inventory. Didn't know how to forecast inventory. Didn't know how to, uh, you know, uh, create, um, you know, a finished good in a reasonable amount of time and didn't know, uh, understand, um, how to run a cash flow model.

Didn't understand how to run a 13 week cashflow model. So there were a lot of fundamentals of the business that were missing from this, uh, from this particular case that if you go in and you apply, uh, apply just those fundamentals techniques, I didn't really need to understand how to, how to graph something onto somebody's spine.

All I knew, all I needed to understand was how to develop a sales team and, um, running run a cashflow model. Yeah, makes sense. And were you able to take a look at the financials prior to buying into the business? Yeah, absolutely. So that's, so that's always a, you know, a key component of it is, you know, as soon as you sign an NDA with, uh, with the bank and you're, you know, you're interested in pursuing it, the, um, uh, you know, the financials are, are, you know, showing to you, uh, that, you know, those are all, you know, accrual-based, you've got to convert accrual-based, uh, financial statements into a, into a cash, um, 13 week cashflow model, because you know that then your stock just starting to look at it.

Cash in and cash out instead of, um, any type of accrual-based accounting. And then understand what do, what do I need to apply to this business in terms of more work and capital to then start, uh, hiring, hiring salespeople, hiring, um, you know, uh, uh, an operations manager, um, upgrade tack, you know, apply a, uh, an inventory forecast, um, uh, module from, from some type of ERP system that takes, uh, you know, all that does take some cash.

So I got to understand what my purchase price is and then how much additional I need to put in to get it turned around and, uh, and, and cash flowing again. So as long as my, as long as my cashflow model starts to show. Uh, positive over, uh, over time. Um, whether it's at 13 weeks, whether it's 26 weeks or it's, whether it's a whole year.

And that really is a conversation with you and your banker and that's on a case by case basis then, um, you know, that's, you know, you applying that fundamental sound business practices to the business will allow you not to have to know how to, um, you know, get a patent on a, on a medical device. Yeah. Yeah.

Um, let's switch gears a little bit. Um, you had posted in the trends group that there was a lot of opportunities right now, as far as buying distressed businesses because of COVID obviously, um, what are some of those opportunities that you're seeing right now? And then the follow-up question will be, how can we get involved?

Yeah. So there, there are a whole bunch of different businesses, uh, prior to COVID that were distressed for, for very good reasons. Um, either they were, uh, just extremely mismanaged or they were in a bad industry. Uh, but that, that case has. Changed quite a bit with COVID COVID has pushed a lot of good businesses that never would have been ever in front of a special asset banker into distress.

So one situation we've got right now is I'm the seat CEO on a, uh, organic supply, uh, a CPG company that sells organic snacks in through, um, target Walmart, whole foods, Amazon, but they also sold in through schools, um, hotels, airports. Um, you know, if you went through, uh, through their report, you would have seen their product, uh, on the, on the shelf, uh, you know, in one of these, um, uh, kiosks, unfortunately a lot of those channels have shut down and, uh, you know, obviously hopefully temporary, hopefully temporarily, but it's a case where that, that loss is sales push.

What was otherwise a very good business through, uh, through the special assets, because all of a sudden, you know, half your half your sales go away, because those. Channels shut down because of COVID. And now, uh, the bank is looking and saying, Hey, you've used severely broke on your bank covenants on our last quarterly review.

And, um, you know, you're, you're in a, in a cash, uh, cash crunch situation. So that's where we, where we come in. We see, okay, there's definitely upside to this. Um, we don't expect airports, uh, to be. Uh, fundamentally shut down. So there for, um, you know, the rest of our lives, it'll take a little bit more time. Uh, we do expect, uh, you know, continue cash burn, how much more cash do we need to put in as business to be able to still keep the lights on and keep the other customers that targets the Walmarts, the whole foods still, um, still a supply.

And that's basically our, our entry point into this, um, into this company. Uh, so I'm this, I'm now the CEO of this company, um, and we're just applying good fundamental cash management, uh, to the, to these guys to reduce the amount of cash burn and, um, you know, get us, get us back into a position where we're, um, where we can actually start selling into the airports and hotels and schools.

Once they start reopening up. Yeah. Yeah. That makes sense. Um, are you actually looking at, uh, buying an airport right now? Uh, uh, you know, really we're just selling into airports. Um, it's a, uh, We, none of those positions, you know, none of those types of companies have actually presented themselves to us.

We're we're not, I'm not actively looking for anything specifically. I'm waiting for the special asset bankers to set, uh, you know, to tell us what they have on their file. Okay. So you're completely agnostic as far as the, the industry that's right. Okay. I'm more, I'm more, I'm more worried about how the deal can be structured and, uh, is this business can be turned around rather than worried about any types of specific industries in, in our, in our firm or we're managing anything from, um, you know, from construction pro uh, uh, projects that want arrive to, uh, CPG snacking companies that sell into airports.

So pretty a broad range of, uh, different types of businesses. But again, it's just applying. Good business fundamentals and knowing what to look for when you are trying to structure a deal, just to make sure that you get your gig, don't get yourself into too much trouble. Yeah. And, um, how can, um, people without a, uh, sophisticated finance background get involved in, in this business, if they want to get, um, some upside from distressed businesses.

Yeah. So I am putting a, a program together called hack the capital stock. Um, you can find, you know, you can find this, the sign up details on my, uh, on my Twitter page or my sub stock page. Uh, it's it's a case where I'm laying out what, what you need to look for when you're structuring the deal, uh, to again, keep yourself out of trouble.

And then ultimately, what are those five to 10, uh, uh, you know, components of a good, good business management or that are gonna yield you the greatest results. So kind of that 80, 20 Parado rule is what are, what are the things that you need to ultimately go in, in, in those first hundred days or first 200 days?

Uh, really, uh, depends on the negotiation with the banker. And then also how to speak with, um, speak with your stakeholders. Speak with, um, you know, speak with the employees, speak with the creditors, uh, whether secured or unsecured and, uh, ultimately how to, how to present a turnaround plan and what those components of the turnaround plan are to be able to then start to fundamentally turn around a business.

Um, in the, in the program I lay out, um, who's who should be on that team. Uh, and, but ultimately, you know, if you, if you feel that, Hey, I've got a capital, I want to put into this business, but I'm just not comfortable at the execution component. Uh, firms, firms like myself, like new point ITT, um, our, our available for hire to be able to actually do the management of those.

If you just feel like, ah, I'd rather just put the money in and let somebody else deal with that with those negotiations and structuring the deal. And, uh, what's the minimum buy-in with your firm currently? Uh, typically we won't look at the, uh, um, any firm that's doing under 5 million in revenue that's.

Um, those, those types of businesses are just too small to me, uh, to be profitably turned around. So, uh, the sweet spot I would say is really kind of 20 million to a hundred million in revenue. Uh, but five to 20 million is, is still very much a possibility. Uh, it would just, you know, we just have to take a real harder look to make sure that there's still cash at the end of the day, to, uh, to get this company out of the distress, uh, position and stabilized.

Yeah. And, um, speaking of Twitter and speaking of the 80 20 Pareto principle, we'd actually gotten this, uh, question on Twitter earlier because I tweeted out about questions. Um, yeah. Can you actually tell us about this? What is the 20% that will yield 80% of the results? Um, yeah, I had actually responded that gentleman, uh, you know, really my first response there was get your cashflow model.

Up and running. That is your key tool to understand what am I going to run out of cash? Because cash cash is King that old mantra understand what your cash balance is. What's your, um, what's your burn rate is when are you going to stabilize and how much, uh, how much collateral and protection does your creditors have so that you can really understand what your, um, what your bottom line is from a cash perspective.

I'm actually not even worried about. And I actually spend very little time with the accrual financials, got to during a turnaround, not to say that they're not important, but the cash flow model is ultimately really what you need to understand. And, uh, and, and to manage, to get through, get through a turnaround.

Once you, once you establish a cashflow model, then you have to start playing around with the variables to say, do I need to get paid faster? Do I need to stretch my suppliers out? If that's, if that's a possibility, do I need to cut costs? Do I need to increase revenue? Um, what are the, what are the fundamental business systems that you need to put in place like quickly?

To be able to start, um, you know, improving, improving your CASP Tash position and get, get stabilized because as soon as she gets stabilized, then you can have a much better conversation with your banker to say, um, uh, Mr and Mrs. Banker, I need you guys to stand down, pull me back in a row, uh, to, with relationship banking and let us, um, then start running, running with the business and allowing it to grow again so that you're buying, buying for pennies and selling for dollars.

Yeah. That is, that is a nice, uh, a nice 80, 20, um, obviously much easier said than done. That's why, uh, you know, professionals such as yourself exists. Obviously, actually I have one last question. Very personal question, actually. Uh, so I have some, uh, you know, basic finance knowledge, um, but I actually studied computer science in college.

Um, however, my dad is a CPA, so he taught me kind of like the fundamentals. Um, what are some resources that, you know, non-finance educated folks could, uh, um, could check out to get a better understanding of this? Uh, are you talking about distress turnarounds or are you talking about, um, just like finance in general, I'm talking about finance in general, because that seems to be the prerequisite to understanding this and succeeding in this space.

Um, one book I like, which is more on, um, the, uh, like how to operate a business, uh, from good to great. I think that's, that's a really strong book. Um, another, another fella in my industry wrote a book, his name's Jeff sands. Um, uh, he wrote a book on how to fix it any business on a hundred days. Obviously, you know, my, my, my stuff, um, is, um, uh, w I think will show you a lot as to how to do it.

And then, um, re you know, read, just read anything on the, um, uh, online, like investing like Warren buffet style. I think, um, you know, he, he's obviously like, you know, classic value investor, but just like the components of how to look at a business from it's, you know, it's book value to, uh, you know, understanding the different student books value and a going concern value.

I will help you a lot on, uh, just trying to, uh, come through deals and just kinda understanding what w w w how you can turn pennies into dollars, basically. Yeah. Yeah. And, um, is there, is there businesses around that you can buy for say, you know, a hundred grand, or would you need seven figures to start doing this?

Uh, if you, if you want professional, um, professional advice, it would be seven figures. Um, but yeah, there's trust me. There's a lot of smaller businesses out there that you can start with, start with a hundred grand, um, that, you know, it's, uh, you know, and again, I've seen, I've seen businesses being sold for $1.

But that, you know, that $1 means any, any lawsuits or any, um, any creditor comes out of the woodworks after you buy it as your responsibility. So you could be, uh, you know, exposing yourself to risk, uh, for, you know, hundreds of millions of dollars. So I never, never recommend doing that. Um, but you know, it's, you know, there's definitely, definitely lots of businesses out there that are struggling in that.

You know, and that a hundred to 500,000, but you know, then you're kind of on, you're pretty much on your own toe to turn it around. Yeah. Yeah. It makes sense because the big players aren't interested, it's not enough upside, right. Yeah. And then, you know, if you want to hire a return on professional, as there's not enough cashflow in the business to be able to, to justify that expense.

So if you're, if you're, if you've had some experience, um, you know, uh, either corporate or entrepreneur running a business and then you want to buy distressed businesses. So not a hundred thousand than, uh, than you're actually, that could be a space for you. Yeah. Gotcha. Gotcha. All right. Well, I'll have to make some more money then first,

uh, uh, you know, the, um, those, those smaller businesses tend not to be through, um, special asset bank, or they're just too small. The bank's going to just write them off, but, you know, just keep your eye out on, um, you know, just business broker websites, um, or, um, you know, just classifieds. To see who's, who's put their business out there because often when you, when somebody's trying to sell their business, there's something wrong with it.

It's not a, it's not that they're, um, at the top of the top of the market and all of a sudden they want to sell high, it's like, they're trying to try to try to dump it. Yeah. Yeah. And, and obviously there's all kinds of. This is kind of like my, my biggest nightmare. Right. You buy into a business and then there's all kinds of lawsuits, all kinds of shit happening.

And, um, you're stuck. Right. Well, that's, you know, I show that in the course as to how to kinda get around that you're either doing an asset sale or you're putting a whole bunch of reps and warrants on a sheriff sale, um, uh, to protect yourself. But that's like 100% part of what I'm trying to teach here is, uh, you gotta, you have to protect your downside so that, you know, um, the pennies don't become dollars.

If you don't want him to say, yeah, I know, I know what you're saying, but like, so there is a way, um, of knowing about potential lawsuits ahead of time. Oh, uh, yeah. I mean, yeah. You know, the, the, the known lawsuits is one thing like this company we just bought into is ha ha actually has a lawsuit on it. Um, so this, um, the CPG company I was explaining has a lawsuit on it.

As we're actually pushing it through, um, a, we bought it with Roxanne warranties so that we're, uh, we're uh, our firm is not personally responsible for it, but you can also push it through a what's called sub chapter five bankruptcy. Um, and again, I'll show I'll I'll look, it gets a little, a little dense, but I'll show that in the, uh, in the course, as well as to how you can actually protect yourself and, and keep, keep your equity in the company.

Nice. No, it's a, it's a new, it's a new law in the U S bankruptcy, uh, closed that actually just came out just pre, pre COVID. So it's, it's pretty new. So that's why, uh, it's a part of chapter 11. I don't know if you've ever heard of chapter 11 or not. Yeah, of course. Of course. It's a, it's a sub code two 11. Um, uh, but, uh, you know, if you, if I put, you know, a million bucks into a company, pre pre bankruptcy, sub five chapter bank, bankruptcy that I still get to keep that million at the end of the day afterwards.

Yeah. Yeah, no, that makes total sense. That makes total sense. Um, but yeah. Any final thoughts? Uh, you were talking about the program you're, uh, you're starting, uh, when is that going to open up? Yeah, I provide a lot of free content already. Um, you know, if you wanted to sign up for my, um, my sub stack, and again, you can find the link through my Twitter at, at Michael Michael Jamo or my sub stack, Michael Jamo dot sub stack.com.

Uh, feel free to send you the, uh, the free stuffs. Um, the way to structure the deal or the way to control risk and the, um, the, the, the real components of what to look for from a turnaround for, um, a deal in which stuff to avoid. And then ultimately again, into case studies and some, uh, other specifics about how to manage your, the rest of the capital stocks, specifically, your secure creditors, um, will be made available, uh, like, you know, in the next couple of weeks, um, One thing I did, uh, we haven't touched on that.

I wanted to include into the, um, Into the, into the course is, uh, sub chapter five bankruptcy. Uh, so that was just something that's, uh, I, I needed to, um, uh, get a little bit understand, cause we're actually going through one right now that is a component of the bankruptcy code that actually allows the equity equity holders, uh, to stay whole.

After after you file. And there's actually some really nice upside that can be a, that that can be structured into those types of deals that, um, that I'll, uh, kind of walk you through, uh, into the court. Nice. And we'll link it all in the show notes. Of course. Um, yeah. Michael Jamo. Thank you so much for coming on the show.

Um, learned a lot today about finance. Uh, it was a bit, you know, heavy at times, but, um, I think you did a great job explaining it. So thanks again for coming on. Oh, thank you. Yeah, there was definitely a lot of, um, uh, heavy components to it, but, you know, just keep, keep in mind. There's a lot, there's a lot of resources out there to, to help you.

Uh, and there's a, um, it's really just comes down to if you're familiar with, um, and, and good at setting up structures for businesses. Uh, then, you know, uh, get entering, entering this distressed space actually becomes a lot easier because all you're just going to do is apply those good fundamental business structures to, um, to businesses that likely never had them before.

And if you're a, um, someone without any business experience, would you suggest the first step is to get that business experience? Or can you start out as a turnaround investor straightaway? Um, you can still start as a turnaround investor, but, you know, I would highly recommend any of the turnaround process, uh, leveraging a, uh, a term professional, um, uh, to, uh, translate, uh, handle the process for you.

I wouldn't, I wouldn't dare do that if I don't have a good, fundamental understanding of how to run a business. Um, but again, there's lots of, lots of turnaround resources out there to, uh, to help leverage if you want to enter this space without actually operating the business. Sweet sweet. Um, and again, we'll link a bunch in the show notes.

Thank you again so much, Michael, and, uh, have a fantastic day. Thank you very much. Appreciate it. Thanks so much for listening. If you liked the podcast, please subscribe and leave a review on iTunes or Spotify and share the episode with someone, you know, really helped me out a ton new podcasts coming out every Monday.

See you next week.