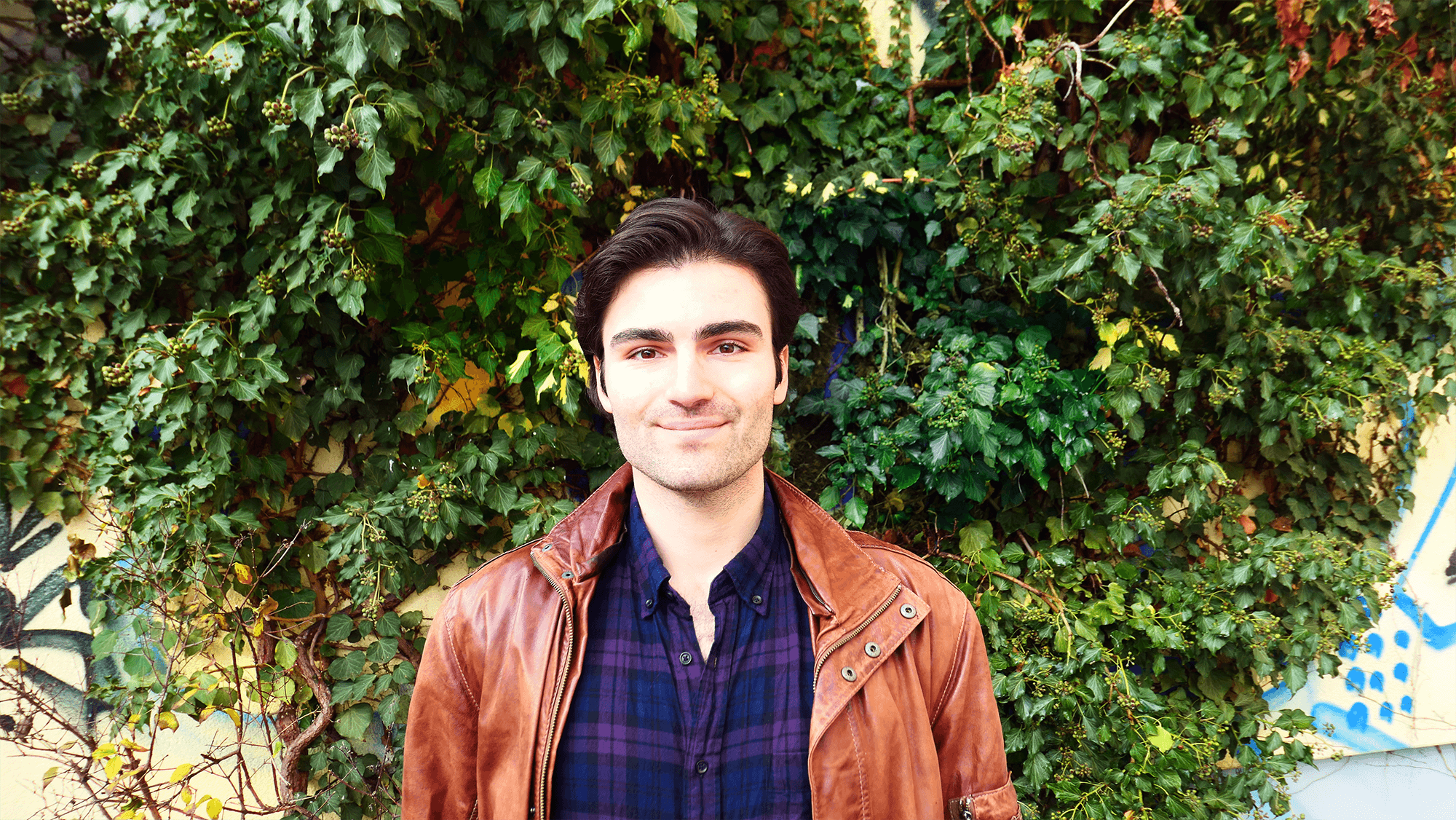

Gabriel Haines is a crypto expert and host of “Talking Crypto with Gabriel Haines.

Some things we talked about:

- DeFi intro for beginners

- Cold storage vs crypto wallets

- Social tokens vs NFTs for content monetization

Shownotes

Where you can find Gabriel Haines:

Twitter: @gabrielhaines

Subscribe to his Youtube for more DeFi content

Telegram crypto chat group

Transcript

Yeah, I'm just, I'm just asking a bunch of maybe, um, noob sounding simple questions, because I want to just make this kind of like resource for people... Listen, my goal is to explain DeFi to the least sophisticated DeFi user.

Thank you so much for coming on the show, Gabriel. Oh, pleasure to be here.

Yeah, for sure. Um, yeah, we have a lot of, you know, crypto DeFi stuff to talk about. Um, maybe, um, because I really do want to make crypto and defy more approachable for like the everyday person. A lot of the people listening right now don't even know what defy stands for. So if you could explain what it means and um, why we should be excited about it, that will be great.

Okay. So. This is my approach here. First of all, we have to understand what Bitcoin is and Bitcoin is a non sovereign money. What does that mean? It means that it's money that isn't controlled or run by any state. That's a pretty big deal, right? All the, all the money that we're used to using dollars or shekels or whatever.

Yeah. It's all created by the centralized government. Right. And to have Bitcoin is to have a, you know, a currency or a money, a form of value outside of the system. Um, you know, and that's one of the big benefits. Of course there's many other benefits it's, it's, you know, liquid could sell at any time, easy to transfer and all this kind of stuff, but.

For the purposes of defy. I mean, the, the big issue here is that we have this currency, right. That we, that exist outside of these systems, but natively Bitcoin doesn't do much. Right. It does just transfers essentially a little bit more, but essentially that's it. And we have all sorts of other financial activities that.

You know, people would like to do with their funds, you know, borrowing lending, uh, and all sorts of different things. And that's what defy is. So defy is the ecosystem in which you have. The ability to do these financial transactions in a way that exists without outside the context of the government and the permissionless.

The idea is permissionless. This means that there's no one that can stop you from interacting on the network. And there's no one that can interfere with, you know, kind of change the books so that. In a nutshell is what the fight is. It's decentralized finance is the ability to do financial transactions in a permissionless and open source way.

Yeah. Thank you for that. And, um, it, it is actually a huge deal because obviously this means everything. Um, you know, all of wall street, all, uh, you know, old school, financial institutions. Um, are threatened by defy, by decentralized finance. And, um, the question is, um, and there's definitely the bears and the bulls, whether on this, whether, you know, over the next, say 10, 20 years, um, everything will be defy and, you know, wall street, the city of London, as we know them, well, basically, um, Either go with the times and, you know, go over into like a decentralized protocol or whether they'll be crushed, which is what I think is more likely, um, by, uh, by new players.

Um, probably I have a feeling you're very biased, but what's your take on this? I mean, I think that it's, it's gonna be quite a struggle. I don't think this is going to be a very simple process at all. Um, I think that these traditional finance or institutions will need to adapt in order to be competitive.

So I think that. They won't just disappear and necessarily, you know, I don't know if they'll get crushed, even they might be able to, you know, adjust, but, you know, DFI is so much easier to use. It's much cheaper. It's much faster and it's just more efficient. So eventually I think the technology. And the system of defy is going to win out, but that's, you know, there's, there's, there's a lot, there's a lot going on.

I mean, it's, it's going to be a very long process. And I think that beings will start to integrate into different forms of defy. And, uh, I've, I've heard people say that there's going to be two different types of deep finance that exists on, um, No, I have a theory of blockchain and that is kind of a KYC type finance, where you have to put in your information in order to interact with the blockchain, like a nexus mutual, for example, it does something like that.

Um, and there'll be true defy where you won't have to. I mean in the former, you know, banks and stuff will, and States will interact with those. And in the latter, there's going to be basically no KYC. It's going to be a lot more rogue and, you know, and that's like, um, I don't know, cover finance, cover protocol, for example, I mean, it's just two sides of the same coin, but they're servicing different markets and they're going to have to adopt these, uh, this technology because it's just new technology.

It's just better. It's like saying, Oh, we're not gonna use iPhones. You know, it's just not going to be possible at some point. Yeah. Yeah. So, um, So you're saying we are headed toward this sort of more decentralized world, but not necessarily, uh, not necessarily, you know, it's gonna take a longer time. Is this correct?

Is this, this is sort of what I'm hearing. Yeah, I don't think this is going to be a very quick process. I think that there's many, many people that have very strong incentives to keep, um, the way the status quo. Right. So. In that situation where we have very powerful, wealthy people who run traditional finance, they're not going to just say, okay.

Yeah, we're just going to go to this other stuff and, you know, undercut our business. Like, it's just, it just doesn't make sense. Right. Um, so, you know, they'll fight pretty strongly. You know, lobbying and government and doing all sorts of stuff, taking out their, their friends to fancy dinners. And, uh, yeah, and in that way, there's going to be a lot of trouble to, to move to this, like, you know, kind of utopian dream that we all have, where it's just, you know, easy and, and all this kind of stuff.

Um, but I, it's going to take a long time, I think, and it's not going to be super easy to get there because people are making money as it is, and they don't want to change the rules so that they start not making money. Yeah, yeah. Yeah. For sure. So, um, on that note, how do you actually, uh, personally get started in crypto and you know, how do you, how do you get into crypto in the first place?

Yeah. I mean, in general you have to use it. That's really the only way to know. I mean, in order to learn how to, how to do this kind of stuff, there's only so much you can learn from reading and watching. You have to start to interact with all these different protocols. And that requires a lot of patience and interest and passion in the subject, because it's not very easy right now to interact with these, these projects.

But, um, It's not insanely difficult, right? It's not learning how to code it's it's, it's just knowing how to do certain processes. And once you understand how to do those things and understand the concepts and you understand them by using them, then you get the hang of it. But, but, but it does take time. I mean, it's not easy, uh, by any stretch of the imagination and.

This industry is growing rapidly by the day. So in order to keep up, I mean, it's, it's almost impossible unless you want to be in a full-time, but you can still benefit greatly from. The ecosystem, even if you, if, even if you just spend a few hours, a few hours a day or, you know, a few hours a week on it. Um, so like, if I, if I want to get started, right.

I have no background. I'm not technical. I have no background in crypto. And like, what's, what's my first step. I buy some Ethereum or some Bitcoin on some exchange or what do I do? Yeah. Yeah, you buy some, you know, first of all, I don't deal much with Bitcoin. I deal almost with Ethereum. I, I, I'm mostly on a theater.

Like that's where, yeah. That's where all the innovation is happening. So that's where I spend most of my time. So in order to start to participate, what you need to do is you need to go on Coinbase or Binance and buy Ethereum and then move it into probably a meta mask wallet. And Metta mask is just a wallet.

It's a web, a wallet that exists in your browser and it allows you to connect to all these different applications. So once you have some Ethereum in your medical mask wallet, then you can interact with, um, no defined and each time you do a transaction, it costs a little bit of a theorem, right? So. At the beginning, it's going to be pretty expensive and you're not going to be making money.

You're probably going to be losing money when you make these transactions. But the best thing to do is to interact with some of the most basic ones, for example, compound. So compounds that allows you to borrow and lend, um, tokens. And in this situation, when you're just getting started, getting familiar with like a U S DC, which is a dollar stable point is something that is going to be critical for understanding how works.

And USB-C is just a token that represents $1 in a bank account. It's very simple. So you can right now go on compound and you can earn approximately, uh, 15% annually on your USB-C. And when you compare that with your bank accounts, it's probably a hundred times or more what you're making in your bank account and, you know, compound.

Is relatively secure in the sense that it's never been hacked as a very good team. So I would feel very comfortable leaving money there for, uh, you know, a long period of time. So if you have some Ethereum and you have some USD coin, which you can also buy in Coinbase, Or you can use unit swap, which is also very integral part of how defy works.

I mean, to flop allows you to exchange between different tokens. That's what exactly what I do. So I would, I would try to acquire some Ethereum, acquire some USD coin and then deposit that USD coin into compound and start to, you know, getting some interest. Yeah. Yeah, that, that sounds like a that's that sounds like, you know, anyone can do that for sure.

And, um, and then like the next step, if you want to, um, kind of like, yeah. Get deeper into this space. Is there like two or three main, I don't know, online, you know, forums or maybe online, um, newspapers, um, where, where to get your news basically, if you're. Deeper into this. I don't go with any news per se. Um, Twitter is the main hub for all the information in crypto, as far as I'm concerned.

Okay. Now it is quite hard to curate, you know, a good feed. Um, but if you're, if you're, you know, new to the space and you want to just learn, what's going on. There's some people that do really good content and, uh, Bankless is really good. Um, the defiant is really good. And again, this is not really news.

It's not news per se, but I mean, they do talk about current events sometimes, but, um, Yeah. And also the fi dad is very good. Again, it's on news. It's more like tutorials and stuff. Um, I don't re like, I don't really go with after like news other than from, uh, Twitter, like the Twitter feed. Um, but, but I think that listening to podcasts and like understanding how people are thinking about their projects is a really good way to start to learn more.

Yeah. Yeah, for sure. For sure. And, um, what was I going to, I saw you, um, talk a lot about, get coin on your Twitter. Uh, could you maybe explain what good coin is and um, why, why you're using it? Yeah. Good coin is a crowdfunding platform that is focused on. Project crypto projects. Now they have a unique feature which is called this idea of quadratic funding and quadratic funding means that the more people that contribute to a particular grant, the more funding they're going to get.

By a funding pool. It's kind of like a matching bonus. So what does that mean? So if 10 P like, so there's, there's two people that are actually contributing to these different grants. There's the funding pool, which is a bunch of different projects, big projects within crypto. Um, the Ethereum foundation. Uh, crack in chain, link sushi swap you swap Badger.

All of these projects committed a certain amount of funds to the good coin ecosystem for this round. And there's also community members, you know, people like you and me who contribute, you know, use these different applications and, uh, you know, want to give back. Right? So. So if 10 people, you know, contribute 10 die to my grant, I'm actually going to receive an exponential boost from the funding pool.

I'm going to get a pretty nice matching bonus from these bigger projects who are funding. Okay. But for example, if some individual, if one person gives me a hundred diet, the bonus I'm going to get is the lower from the funding pool. So the idea here is that the more people that benefit from your project, the more funding you're going to get from it, right?

Yeah. So that's kind of ideal. Okay. And obviously you're a, you're a, you're a creator. You're a, um, Community builder. And, um, this is a great way for, for your community to, um, to help you to, to support you, right? It is. It is. Um, I think that it is not the end all be all though. I think that there are, I think this is just one tool.

In the toolkits and there need to be other tools for, uh, community builders to give lock-in like some sort of incentive to their audience. And they have this idea of like social tokens, which is one way. Um, but I have them, I think that NFTs are going to complete are gonna give a lot of benefits to creators.

Uh, like before we get into NFTs. Cause that's literally also my list. Can you just talk about social tokens for a moment? Um, what it is and, um, the question that pops up is, is good coin actually, a social token or not, no get coin has no token. Um, it's funded by consensus, which is. I don't know if I should get into what consensus is, but it funds a lot of projects within the theory him.

Um, so good coin has no token. So social tokens are, are tokens that creators or developers and creators, uh, make in order to, uh, raise some money or fund different projects or, you know, reward their fans. There's it's, it's kind of. Um, it's, it's an evolving space and each social token can have different properties.

Um, so for example, I could, I could make a coin, I mean, or you can make a coin Gabriele coin, right. And every, you know, you could, uh, put it on municipal swap and make a market for it and, and assign a certain price to it. And you could say, if you send me 10 of these Gabrielle coins, Then I will have a one hour, uh, content consultation with you.

All right. And, and then they send you the coins and you could keep the coins or you burn them or whatever. But, but that's just one thing that it could be redeemable for different services. Um, but it also could be like, If, if I am starting a project and people are holding my social token, I may reward them with early access to this project because I know they're, you know, hardcore fans.

Right. So there's a lot of different things you can do with these. Okay. Okay. So th this seems like a great tool for, for creators and for communities to, to monetize and to incentivize, um, The audience. Yeah. Yeah. I, I it's, um, it's not so straightforward my feeling. It's not so easy to make a token that it actually, um, has good utility.

But like, it would be, it would be that it would be kind of like early stage investing. Right. In the sense that let's just say there was like 1000 whatever Gabriel tokens. And then in the beginning, um, you buy one Gabriel token for whatever, $10, and then maybe the creator gets bigger and bigger. And then maybe five years later, the creator is like, I don't know, has millions of followers.

And then that token, that used to be worth whatever $10 is now worth. Maybe thousands of dollars. Would it work like that? Yeah, it would work like that, but again, like, I, I, I think that NFTs are better for this purpose. All right. Let's get into, let's get into this then. And let's hear this. Yeah. Sorry. I keep dragging you over.

I was like, all right. All right. Let's let's do the NFD talk. I think that. Tokens are they have a different meaning to them than an NFT because an NFT is just a collectible, right? And a token comes with a different set of responsibilities. I feel like than an NFT, because when you launch a token, you're trying to say, listen, I'm going to accrue value to this token somehow.

Uh, you're going to get some benefits, but. When you have an NFT, if you sell an NFT, that's it, you'd like you don't have any responsibility towards the holder and then Ft, you know, if they want us to support your project, they like the art, they like the collectible. And that's it right. If the NFT appreciates that and that's great for the holder.

Um, but. NFTs is also have this interesting property that allow you to retain, um, secondary sales, secondary market sales. So if I, if I'm an artist and I create an NFT and I sell it for one East today, right? Yeah. And then down the line, I keep on, you know, I keep on creating and I keep building my brand down the line.

That that NFC sells for, you know, 10 eith I am going to get 20% or 10%, whatever you set directly to my wallet, I'm going to be paid off, you know, residuals on this piece of work. And I think that is a much more elegant solution than just having tokens. Um, Yeah. I think that the NFT functionality is a lot more suited to that, that rather than just distributing tokens and trying to sell the tokens.

That's just my feeling here. Yeah, yeah, yeah, no, yeah. I can, I can see why. So then, um, do you think we are, um, In an NFT craze slash bubble right now, or do you think we're barely scratching the surface and 10, 20 years from now in hindsight? Um, yeah, it'll be just, it will have been just the, the very beginning.

It's both

some of the NFTs that you have for sale. Are are probably inflated in price just because of their NFTs. Right. And NFT is just literally anyone can meet that. So a lot of these are selling for probably more than they should be, but I think that so meaning if you buy one today, 10 10 years from now, five years from now.

I don't think that necessarily it's going to be worth more. It's like, because a lot of them are junk, but 10, five, 10 years from now, I believe that there's going to be so many more NFTs in, in all different parts of our lives. Like going to an event, if you're going to go to a basketball game and Mark Cuban said he was going to do this.

And he, that the ticket is just going to be an NFT. And you're going to scan the ticket and then you're going to walk into the game and you get to keep that ticket as part of like a collectible, right? It's also like proof that you went to this particular event. And maybe if you collect enough tickets, then you can get special items.

Or, you know, if you go to, you know, you could imagine that if. You went to the 10 games during a season, the team may reward you in some way and invite you to a special, you know, whatever. Um, so in this way, like you can build more engagement with your audience. So we're going to have all different types of NFTs that yeah.

And, and there's going to be all sorts of use cases that we haven't even thought of yet today. Hmm. Yeah. Like, do you have any potential, um, crazy use cases in mind? No. I mean, just like, uh, there's, there's all sorts of ideas that you can do in very creative ideas, but again, like. Being able to have people come to events, using NFTs and being able to, I mean, I think it's a pretty big deal to be able to have those liquid markets for event tickets because we all, I don't know.

I've I I'm sure you've been to an event you bought tickets in advance and then whatever reason you can't go. So you have to try to like sell tickets. Oh yeah, of course. It's pretty annoying. So if the ticket was just an NFT, like, and you could have a market for it, that would be super useful just as a, you know, as a consumer, right.

As a, as someone who wants to, you know, enjoy some form of entertainment for sure. Um, yeah, so like that, that in itself is quite valuable. Yeah, for sure. For sure. Um, do you, um, so, so basically your, your focus is entirely on, on a theorem, right? Yes. Yes. Okay. Okay. Not necessarily. I mean, I'm not against any other ones, but I spend 98% of the time on it there.

Yeah. That makes sense then. Um, probably one, one thing you hear a lot are like the, you know, the gas costs. So, um, basically, like you said, when you, when you make a transaction, um, with the theory them. In defy, you have to basically pay for the privilege of using, you know, the network, the blockchain, and right now cost can be really, really high to the point where, um, you know, you make a $100 transaction and then you have like $10, $10 fees.

Right. Um, do you think this is something that's going to get fixed soon or, um, yeah. What's your take on that? I think it's definitely going to improve over time. Technology has a way of becoming cheaper and faster all the time. Right? So the issue of the theorem being slow and expensive is to me, just a temporary thing.

It's not going to be solved by like magic, but you know, five, 10 years from now. We're not, we're not going to be faced with this problem so much. And there already are solutions. Um, MADEC and is, uh, Ethereum side chain, uh, that, um, that I think is going to innovate a lot in this space, but we're already seeing a lot of cross chain stuff.

So I think that this, this is going to get, um, More more user-friendly over time. Um, but, but it could be that the, you know, the Ethereum one itself, like where most of these applications exist will, will be just like a institutional or like to whale network, meaning that. If you want to get the extreme security of the and you want to make sure all of the, you know, the transactions is settled correctly then, and if you have, you know, a good amount of funds, you know, hundreds of thousand dollars, then you're going to be willing to pay several thousand to, to transact on a theory.

Right. Um, And then we'll have all these other, you know, or side chains or Zika roll-ups that will allow, you know, smaller transactions that take place at much more cost-effective prices. So I'm not too worried about it, but, okay. Okay. Yeah. Yeah, that, that, that could be a great solution to that. Um,

Yeah, I'm just, I'm just asking a bunch of maybe, um, Newp sounding simple questions because, um, uh, I want to just make this kind of like resource for people, because I do get asked a lot of these things quite, uh, quite a lot. And I think a you're better at explaining this than, than I am. And B this is just one thing where like, moving forward, I can just send people to this podcast, you know, and, um, So, you know, uh, maybe forgive me if some of those questions sound a bit basic.

Listen, my goal is to explain defy to the least sophisticated DFI user. So I really do try to fill this. Gap, um, where all the stuff, all my videos, all my content is trying to be as basic as possible. And there's going to be terminology that newcomers won't understand, but that's understanding the concepts like stable coins, liquidity provide thing.

And those types of concepts are, are critical to understanding how the Phi works and how to use it the best. So, uh, yeah. Feel free to ask any simple questions. That's perfectly fine. Yeah. One question. Yeah, actually, um, I got from my mom and my mom is, you know, non-technical um, she was asking. Okay. So there seems to be so many, um, there seem to be so many great, um, Basically bonds and like, and like, you know, 20th century speak or like, you know, in defy, you know, they give you whatever 10%, 15% for your money.

And obviously right now, you know, you'll get 0% interest rates or like maybe you get a 1%, um, in certain countries you get negative interest rates even. So you lose money. Um, But it's kind of the wild West out there still. So, um, how should a non-technical person that's new to defy go about identifying, uh, identifying a trustworthy, um, let me call them defy bond that is worth, um, yeah.

Giving some money to, yeah, I don't know about the idea of a bond, but the example that I mentioned with compound. I think is something that everyone should be interested in. Especially if you have money in the bank that you, you, you would like to lend out for a higher rate. So I D I just call it bond because it's kind of like a nice heuristic for people that don't know defy.

It's kind of like a bond. But it's obviously not a bond, but yeah. It's like a savings account compound is, is a savings account. That's, that's it. I mean, it's just very simple to understand, right? So I'm looking on their website now. And like I said, you can lend us DC. Four five points, 7%. I said like 10% before, so I was a bit off, but these rates fluctuate a lot.

And in case 5% is still far more than you will receive. Um, and your bank or buying any type of, you know, like, uh, like a treasury bill or something like that. Um, so I think that if. If you want to like, start to understand how this stuff works. And then then doing the steps that I explain well with compound is going to be the best way to get started because compound is extremely secure and it is very, very low risk.

So, and it's very simple to understand. Um, all you do is you just deposit your USD coin. And you wait and it goes up slowly and that's it. And, uh, that, that, and again, the rate you're going to get there is far superior to any rate in traditional finance, as far as, you know, just dollar yields. Okay. Okay. So that's a, that's a good starting point.

Um, do you have another starting point? Maybe if someone says, okay, I have a couple thousand dollars I'm willing to, you know, start investing in, playing around with it. I'm going to allocate whatever. Maybe 30%, maybe 15 per 50% the compound. Uh, where else should they, should they look maybe. So if they're feeling lucky, you can check out pool together and pool together is pretty interesting.

It's a no loss lottery. So what does that mean? So you put your tokens in, and then at the end of the week, all the interests of all the tokens in the pool, Are distributed to one to three people. So everyone pools their money together, and then there's a lottery and whoever wins, the lottery gets the prize.

So unlike your traditional lottery, you still have your assets at the end of the week, right? You still have your tokens that are in the pool. So. Is the idea of a no loss lottery, right? So this is kind of a fun way to, you know, try to get some upside while actually playing it pretty safe and interact and learning as well because you're interacting with different protocols.

And getting comfortable with different projects and understanding how to use them is definitely very important. So pool together is, is a nice one. Um, that's again, pretty secure, just very simple to understand, very easy to use. Um, and, and yeah, I mean, there's, there's a lot of different things you can do on Ethereum, but especially when you're getting started.

I think that that's pretty crucial to keep it simple. Yeah. Yeah, for sure. What do you say, um, as far as you know, tech and hardware's concerned, would you say a, uh, a you first question, should people get, uh, cold storage? Yes or no. And B which cold storage hardware should they get in 2021? According to Gabrielle Heights,

you in general should get cold storage, but. If you're just getting started and you're just learning, it's not required. Um, if you, if you're trying to interact with defy and you're just putting in like a couple thousand dollars, just to just try it out, then you don't need cold storage for that. Um, but if you want to start to put, you know, tens of thousands of dollars, then.

You should start to look into cold storage solution. Um, the one I have is a ledger and ledger is good because it connects with metal mask. So it's very easy to use within, um, you know, Ethereum and defy, uh, however, a cheaper solution. And the ledger is not that expensive. It's like. I don't remember the price, maybe a hundred dollars for three or something.

I like that you have the nano X, the, yeah, yeah, yeah. I don't know the price, but it's not that expensive, but if you want even cheaper than that, you can get a Argent wallet. Which is an app on your phone, your iPhone, or your Android. And this is actually a very secure wallet. This is way more secure than metal mask.

And even in some respects, it's more secure than ledger. Um, and there's a lot of nice features. Would that come with using Argent? Uh, I can get it into them, but it's very easy to use. And it's very secure. However, you cannot connect to every different defined protocol. So if you're a super user, then you can't use it for like your main, um, like your main wallet.

But if you're just, you know, doing some simple things like compound and pull together, like I mentioned, um, it's, it's very good for that. Okay. Okay, good. Um, yeah, I mean, those are two, two good options for people to get started, I think. And, um, I also think that if this is the first time, uh, that you're hearing about, um, defy, uh, your brain is probably fried right now.

So, um, Yeah, maybe we leave it at this. I think this is a good kind of intro explainer first step sort of podcasts for people to check out. And, um, Gabriel, Gabrielle, um, any, uh, parting thoughts, uh, anything you want to plug now's your chance? Yes. So make sure that you subscribe to my channel.

Youtube.com/gabriela Hanes. Got a lot of good content up there. You need to have some experience on a theory them in order to understand maybe some of the concepts, but once you have the basics, I highly recommend you subscribe and listen. Even if you don't understand the basics, to be honest, because again, the only way to learn is by going into the deep end and asking questions.

So. Subscribe to the channel. And when you have questions, join the telegram group. There was a link in the description of the YouTube. Um, joined the telegram. There is all sorts of people in there. You can ask questions, you can share information, good place, and also follow me on Twitter. And Twitter is the lifeblood of defy.

Right now, I think that's where all the information is coming. And, um, so yeah, that's, that's pretty much it. That is what I suggest people do. Right. And we'll link it all in the show notes. Of course. Yes. All right. Thank you so much for coming on and explaining the fi and, um, have a fantastic day, Gabriel. My pleasure. Thanks for having me.

Thanks so much for listening. If you liked the podcast, please subscribe and leave a review on iTunes or Spotify and share the episode with someone. You know, it really helped me out a ton new podcasts coming out every Monday. See you next week.